Can Cash App Be Hacked?

By Simon Lewis

Published:

Cash App is a popular mobile payment app that simplifies sending and receiving money.

Users can transfer funds by simply entering a recipient’s email address, phone number, or unique Cash app tag (also known as a $Cashtag).

However, with the increasing reliance on digital financial services like Cash App, security concerns over online financial transactions become heightened.

Can Cash App Be Hacked?

One of the most common threats to Cash App users is scammers employing social engineering tactics. These tactics involve tricking people into revealing their login information or sending money by impersonating legitimate representatives or creating false scenarios to gain trust. (We’ll delve into these tactics in detail later.)

While rare, Cash App has been compromised in the past. In December 2021, a former employee accessed and downloaded internal investing reports of approximately 8.2 million customers containing sensitive information like:

- Full names

- Brokerage account numbers

- Brokerage portfolio value

- Stock trading activity details for one trading day

Thankfully, key financial details like bank account numbers, social security numbers, or login credentials were not exposed.

Despite these incidents, the likelihood of a verified Cash App account being directly hacked remains low. Cash App utilizes robust security measures, including encryption, fraud detection, and secure login options, making it difficult for hackers to directly breach the app’s systems.

While Cash App is relatively secure, it’s crucial to know how scammers exploit users and potentially gain access to their accounts. Understanding these methods is the first step towards protecting your money and personal information.

Let’s delve into how scammers can infiltrate your Cash App account.

Common Ways Scammers Can Gain Access to Your Cash App Account

While the Cash App platform has decent security, scammers use various tactics to target individual users. Understanding these methods is the first step in protecting yourself:

Social engineering

Scammers use psychological manipulation to exploit your trust. They might impersonate Cash App support, offer a fake giveaway, or pretend to be someone in need.

Their goal is to trick you into giving up your personal or account information, making a Cash App payment to them, or even revealing your bank account details.

Malware

Malicious software, like viruses or spyware, can be installed on your phone or computer through suspicious links or downloads.

This software can track your keystrokes, steal passwords, and other sensitive data that could jeopardize your Cash App account.

Need mobile malware protection?

Stop malware from stealing your Cash App login information. Get Certo Mobile Security for free on Android and iPhone today.

Phishing

This involves creating fake emails, texts, or websites that mimic Cash App’s official communications.

These messages often offer too-good-to-be-true deals or create a sense of urgency to trick you into clicking a link and entering your login credentials on a fraudulent website.

These Cash App scams evolve constantly, below, we’ll discuss common Cash App scams that you should watch out for

Common Cash App Scams

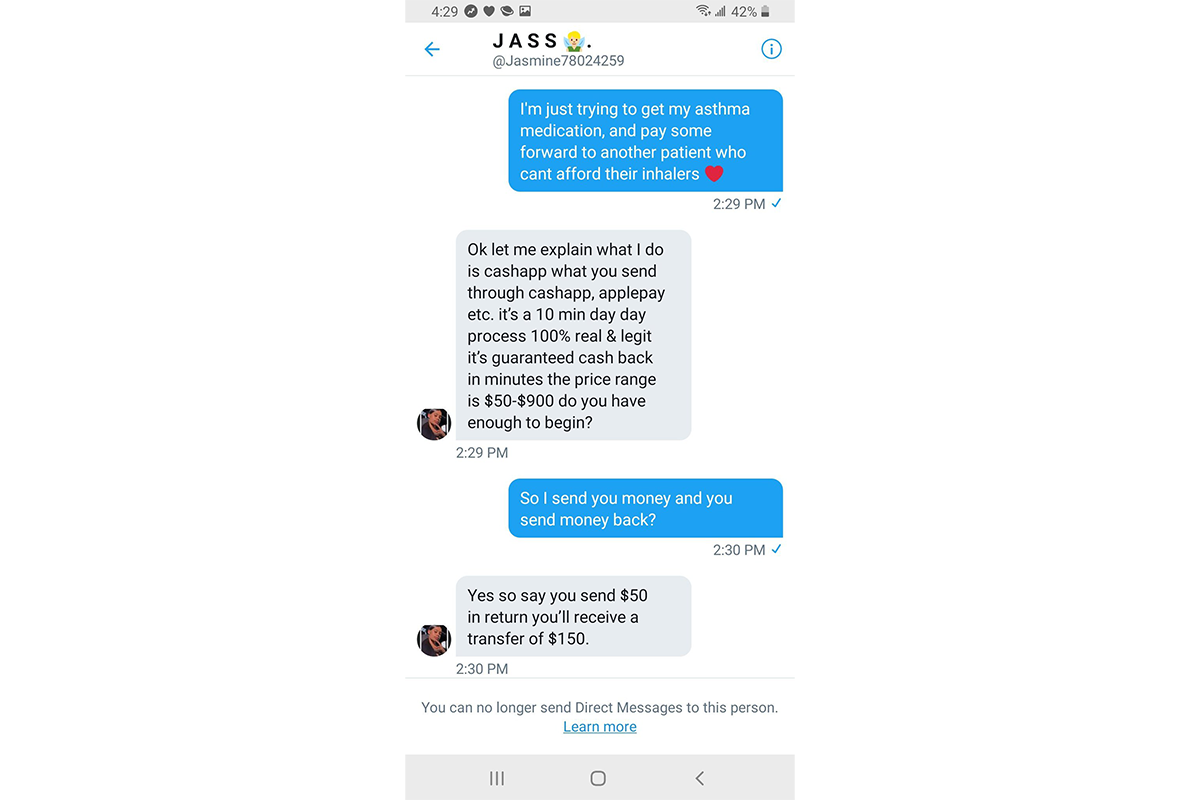

1️⃣ Cash flipping scam

Scammers promote “cash flipping” on social media through fake ads, or direct messages.

They claim to have a system or secret method to “flip” your money — promising to multiply any amount you send them.

They’ll ask you to send them a smaller initial amount (like $100) as a “clearance fee,” “verification,” or “investment.”

They’ll insist that once they receive that, they’ll send you back a much larger sum (like $1,000).

The scammer blocks you after you send the money and disappears with your cash. No “flipped” money exists, and you’re left out of pocket.

How to spot this Cash App scam:

- Any promise to multiply your money quickly is a massive red flag.

- Legitimate businesses or services don’t require payment through Cash App to release funds.

- Be wary of unsolicited offers or claims made on social media.

Image Credit: @Chipmunk686 on X.com

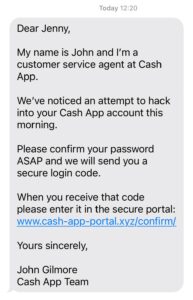

2️⃣ Phishing scams

Scammers use fake emails, texts, or websites that look like they’re from Cash App to trick you into giving away your login details or other sensitive information.

They might claim your account has been compromised or that you’ve won a prize, urging you to act quickly.

💡 Key Point: Phishing is one of the most common cybercrimes. In 2023 alone, the FBI's Internet Crime Complaint Center (IC3) received over 298,000 phishing complaints.

How to spot a phishing scam:

- Check the sender: Official Cash App emails will always come from a @square.com, @cash.app, or @squareup.com address. Be wary of slight misspellings or different domains.

- Urgent or threatening language: Scammers often create a sense of urgency (e.g., “your account will be locked”) to pressure you into acting without thinking.

- Requests for sensitive information: Cash App will never ask for your login credentials, PIN, or full Social Security number via email, text, or phone.

- Links to unofficial websites: If a link doesn’t take you to the official Cash App website (https://cash.app), it’s likely a phishing attempt.

🪝 For more information, have a look at our guide on what to do if you have clicked on a phishing link.

3️⃣ Impersonation scams

Scammers pose as someone trustworthy to gain your confidence and then manipulate you into making payments or revealing personal details. Here are common impersonations:

⚠️ Cash App customer service: The scammer claims there’s an issue with your account and needs your login information or payment to fix it.

⚠️ A romantic interest: The scammer builds a fake online relationship, then asks for money for an emergency or family crisis.

⚠️ Someone in need: The scammer may pretend to be a friend, family member or work colleague facing a crisis and needing urgent financial help.

Impersonation scams constitute a significant threat because they prey on our natural emotions. They can exploit fear (e.g., “Your account is compromised”), compassion (e.g., “A loved one needs money”), or desire (e.g., “Win a free phone”).

A 2023 study found that brand impersonation scams had targeted 78% of respondents. Plus, nearly half (45%) reported receiving ten or more scam calls and texts monthly.

This translates to a frightening number — over 125 million Americans are potentially bombarded with impersonation scams every week.

💡 Expert Insight:

“Be extra cautious when someone you don't know reaches out, especially if they make urgent requests or offer something that seems too good to be true. Cash App scammers often try to rush your decision or evoke strong emotions to prevent you from thinking clearly.

It's a red flag if someone you've only interacted with online asks you to send money, especially through Cash App. If unsure, always verify the person's identity through other channels.

Contact Cash App support directly, or if the supposed person is a friend or family member, reach out to them through a known phone number or social media account.”

– Russell Kent-Payne, Co-Founder of Certo

4️⃣ “Accidental” payments

Here’s how the scam works:

The “mistake”: The scammer sends you a Cash App payment, seemingly by accident. This amount could range from small to quite substantial.

The plea: Immediately after sending the money, the scammer contacts you. They’ll claim it was a mistake and desperately ask you to return the money. They might use a believable excuse, create a sense of urgency, or even appeal to your sympathy.

The trap: If you return the money, the scammer will dispute the original payment they sent you with their bank or credit card company. This means they get their original money back, plus the money you sent, leaving you out of pocket.

This scam is particularly effective because it exploits people’s natural inclination to be helpful and honest.

At first glance, it seems like a legitimate mistake where you accidentally received money. This makes it easy to miss the fraudulent intent behind the scheme, leading well-meaning people to fall for the trap of returning the “accidental” payment.

How to spot it:

- Unexpected payments: If you receive money on Cash App from someone you don’t know, be immediately suspicious.

- Urgent requests to return money: Scammers often use urgency (“I need this back for rent!”) to pressure you into acting quickly.

- Stories and excuses: The scammer may provide a believable-sounding reason for the “mistake” to gain your trust.

- Requests for alternate payment: If the scammer asks you to return the money using a different method or alternative Cash App account, that’s a major red flag.

💡 Pro Tip: If you receive an "accidental" payment, the safest thing to do is ignore any requests and contact Cash App support for guidance.

5️⃣ Selling fake goods or services

Scammers pose as legitimate sellers on online marketplaces, social media, or even fake websites.

They offer tempting deals on popular items like concert tickets, electronics, or luxury goods that seem too good to be true. Once you send payment via Cash App, they disappear without ever sending the item.

This scam is especially rampant during high demand for specific products or events, like concert tickets.

Scammers exploit this excitement by creating fake profiles on online marketplaces or social media. They pressure potential buyers with a false sense of urgency, pushing them to act quickly before the “deal disappears.”

The Better Business Bureau Scam Tracker illustrates this tactic perfectly. One victim reported trying to buy concert tickets from a seller who insisted on Cash App as the only payment method.

The victim, unfamiliar with Cash App, was further misled by the seller’s claim that the transaction could be canceled. Sadly, after sending $350, the scammer immediately blocked the victim, losing their money without ever receiving the tickets.

How to recognize this scam:

- Deals too good to be true: If an item’s price is significantly below market value, it’s likely a scam.

- Limited seller information: Scammers often have sparse profiles or refuse to provide contact details beyond an email address.

- Pressure to pay quickly: They might push you to decide before the “item sells out” or the “offer expires.”

- Cash App as the only payment option: Legitimate sellers usually offer multiple payment methods. Insisting on Cash App (which has limited buyer protection) is a red flag.

- Lack of reviews or proof: Check seller reviews on marketplaces or social media. Be wary of sellers without a track record or with no way to prove they have the item.

How to Protect Yourself from a Cash App Scam

While Cash App has various security measures in place, your actions play the biggest role in keeping your account safe. Follow these essential tips to protect yourself:

Essential security

✅ Choose a strong PIN: Use unique, complex combinations for your Cash App account. Never share these with anyone.

✅ Two-Factor authentication: Enable this crucial security layer to prevent unauthorized logins. An authenticator app is more secure than SMS codes.

✅ Be wary of links and requests: Never click on suspicious links or respond to unsolicited requests for money or personal details — even if they seem to come from Cash App.

✅ Use the official app: Always use the legitimate Cash App downloaded from the App Store or Google Play. Avoid unofficial versions even if they promise more features.

✅ Real support channels: If you need help, contact the cash app team through the official app or website.

Protect your device

Keeping your phone or computer secure is essential for protecting your Cash App account. Here’s what to do:

✅ Strong passcodes and biometrics: Use complex passcodes on your devices and enable biometric security options (like fingerprint or facial recognition) for an extra layer of protection.

✅ Keep software updated: Make sure your operating system (Android, iOS, etc.) and all apps are updated with the latest security patches.

✅ Antivirus protection: Reputable antivirus software adds a crucial layer of defense against malicious software that could put your Cash App data at risk.

🛡️ Concerned About Mobile Security? Protect Your Device With Certo

Certo Mobile Security is a powerful app designed to protect your smartphone from malware, spyware, and phishing attacks. Available for both iOS and Android, it offers these core benefits:

- Powerful malware and spyware defense: Detects and removes harmful software that could steal your Cash App login or other sensitive data.

- Security audit: Identifies security weaknesses on your device and provides tips to improve your protection.

- Wi-Fi protection: Helps you stay safe online by analyzing your current network for signs of unauthorized monitoring..

- User-friendly: Simple to use, even for those without technical expertise.

Download for free on the App Store or Play Store.

Be smart with your information

Always remember that a genuine Cash App representative will never request sensitive details such as your PIN, password, sign-in codes, full Social Security number, or bank account information.

Be cautious of unsolicited calls or messages, and never share your information with anyone claiming to be from Cash App. Scammers may impersonate representatives to steal your details and gain unauthorized access to your account.

Practice smart Cash App habits

Lastly, here are some general tips on how to use the Cash App safely:

➡️ Log out: Sign out of the app when you’re not actively using it.

➡️ Verify emails: Double-check that emails come from an official Cash App domain (@squareup.com, @square.com, or @cash.app).

➡️ Manage your balance: Don’t keep large sums of money in your Cash App account for extended periods.

➡️ Be wary of strangers: Only send money to people you know or verify carefully (including verifying their $Cashtag).

➡️ Trust your gut: If a deal or offer seems too good to be true, it almost certainly is.

What to Do If Your Cash App Account Is Compromised

If somehow a hacker manages to get access to your Cash App account, here’s what to do:

✅ Act immediately: Time is of the essence when your account security is breached. The faster you act, the better your chances of minimizing potential losses.

✅ Change your PIN: Immediately change your Cash App PIN to a strong and unique one. If you’ve used the same PIN for other services, change those too.

💡Pro tip: How to Change Your Cash App PIN

Here's how to change your Cash App password within the Cash App:

- Tap your profile icon in the top right corner of the app's home screen.

- Select the Privacy & Security option.

- Find and tap on Change Cash PIN.

- Enter your existing PIN as verification.

- Create and confirm your new, strong PIN.

✅ Secure your email account: Ensure the email associated with your Cash App has a strong, unique password and enable two-factor authentication where possible.

✅ Contact Cash App support: Contact official Cash App support immediately. You can do so through the app or their website. Provide details about the suspected compromise.

✅ Contact your bank: If you have linked a bank account or debit card, notify your financial institution immediately. They might be able to freeze your accounts or reverse fraudulent charges.

How to Get Your Money Back If You Were Scammed

Unfortunately, recovering money lost through scams on Cash App can be difficult. The service often warns that most payments are instant and irreversible.

However, if you act quickly after being scammed it might be possible to lessen the damage. Here’s what you should try:

- Request a refund: Open your Cash App Activity tab and locate the fraudulent transaction. Tap the three dots (…) and select Refund followed by OK. Understand that this only sends a request; the recipient must agree for the refund to occur.

- Attempt to cancel the unauthorized transaction: If you’ve realized the scam quickly, return to the Activity tab. If the transaction shows a Cancel option, select it immediately.

- Dispute the transaction: Next, go to the Activity tab, select the payment, and tap the three dots (…); choose Need Help & Cash Support and then Dispute this Transaction. Cash App will investigate and notify you of the outcome.

- Report the scam: Tap your profile icon, select Support, then Report a Payment Issue. Choose the fraudulent transaction and follow the prompts.

- Block and report the scammer: Visit the scammer’s profile, scroll down, and choose Report or Block to help prevent others from being victimized.

- File with the FTC: Contact the Federal Trade Commission at 1-877-FTC-HELP or ReportFraud.ftc.gov to file an official complaint. Also, log this scam on the Better Business Bureau Scam Tracker.

Final Thoughts

While Cash App offers reasonable security measures, staying safe on the platform is largely your responsibility.

Scammers constantly evolve tactics, so awareness of potential threats and practising smart online habits are crucial.

By exercising caution, verifying details before sending money, and safeguarding your login credentials, you can significantly reduce the risk of falling victim to a scam.

Remember, Cash App will never ask for your PIN, password, or login codes.

Protect your information, stay vigilant, and consider downloading Certo Mobile Security for iPhone or Android to protect your mobile device for added peace of mind.